What Do Good Whisky & Successful Investing Have in Common?

What Do Good Whisky & Successful Investing Have in Common?

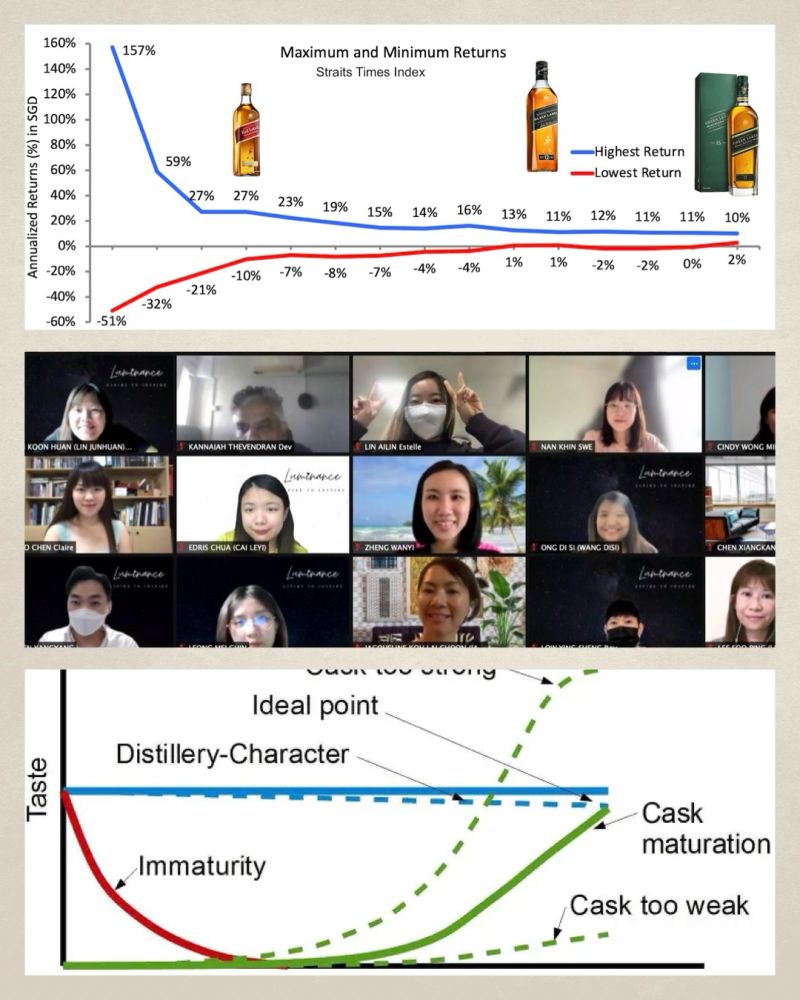

This is not my story. It was created by Lee Soo Ping, representing Prudential Assurance Company Singapore in July 2021 during the UT ILP Investment Sales Master Class (Zoom edition) for directors Joie Lim and Jacqueline Koh and their teams.

The premise is that just like a good whisky needs time to mature, investments also have an optimal holding period. In Lee Soo Ping’s words, there are two main factors to age whiskey – the wooden barrel and the temperature or environment.

The barrel is significant because it’s often the primary source of flavor for whiskey by the time it’s bottled. Whiskey penetrates the wood fibers, breaks down compounds like wood sugars, and then pulls them out of the wood into the whiskey.

The other factor is temperature, or the environment. Temperature plays a major part in this: when wood gets warm, it expands, letting more liquid in. When it gets cold, it contracts, pushing whiskey (and color, sugars, and other flavors) back into the liquid. It’s very much like steeping tea.

Now, the art of maturing whisky really is a waiting game that relies on time and patience. It takes only a few days to distil a barrel of whiskey, but it takes time for the taste to mature.

As matter of fact a good whiskey will take at least 10 years to age, having said that, it doesn’t mean that you can’t drink a 1-3-5 yr old whiskey. Just that it might not taste as good. The flavours just get better as the whisky ages.

When investing in a diversified pool of equities like a Unit Trust or an Investment Linked Policy, you can choose to invest for a 3-5 year time frame. While a 3-5 yr matured whisky (taken in moderation) will not damage you, the chances of losing money in the investment are significant and the losses can be substantial. A look at recent Chinese equity performance exemplifies this point.

For investments a 10 year holding period very significantly reduces the risks and is the expectation which should be set for both financial advisors and customers.

Now that’s something I can drink to !